risks associated with closed end funds

There are several possible areas where distributions. Issues shares to investors when the fundRead More Fundamental Risk Affects.

What Is The Difference Between Closed And Open Ended Funds Quora

Although there are no required minimums closed-end funds are not for.

. Aberdeen Asia-Pacific Income Fund 453 symbol FAP on Toronto Units outstanding. Investors should contact a funds sponsor for fund-specific risk information andor contact a financial advisor before investing. The following list of risk factors provides a review of those associated with generalized closed-end fund investing.

For example say that a closed-end fund has 100 million in net asset value and 10 million shares. Often low-volume trades can make it harder for quick sell action. Expense ratios or the cost of owning the fund each year may also be lower compared to some open-end funds.

Because closed-end funds trade like stocks they will trade higher than the NAV at a premium or lower at a discount. The risks associated with this type of fund mainly include market risk and how that can affect pricing. Its NAV is 10 per share.

Closed-End Fund Association Along with the usual risks associated with investment in equity markets such as market risk inflation risk political risk etc. Other Disadvantages of Closed-end Funds Use of leverage in trading closed-end funds can create undesired adverse effects on the fund. Other fund operational risks may arise following the termination of the fund such as the following.

This is particularly challenging due to sensitivity to interest rates. Examples of closed-end funds include municipal bond funds. The leverage huge expense fees and uncertainty around the discount longer-term investors are usually better off with an ETF.

Wwwaberdeen-assetca is a closed-end fund that invests in foreign currency bondsmostly from Australia and Asian countries. Based on these risk factors and others. Closed-end funds also known as closed-ended funds or CEFs and open-ended funds appear to be the same type of investment in many ways.

There are also problems when trading in low volumes. So if you buy an SP 500 ETF and the SP 500 goes down 50 nothing about how cheap tax efficient or transparent an ETF is will help you. Just like open-ended funds closed-end funds are subject to market movements and volatility.

D mental fear and worry are present. Risk factors pertaining to closed-end funds vary from fund to fund. At times discounts could widen or premiums could shrink either diluting positive performance or compounding negative performance.

Like a mutual fund or a closed-end fund ETFs are only an investment vehiclea wrapper for their underlying investment. In addition each closed-end fund is subject to specific risks that vary depending on its investment. Shares of a closed-end fund may trade above a premium or below a discount the NAV of the fund.

If you look at those three big risks in closed end funds. Additional risks of the Fund are associated with international investing such as currency fluctuations political and economic changes market. What are the risks associated with Closed-end Funds.

The funds MER is 111. As always it is important to consider the objectives risks charges and expenses of any fund before investing. General Risk Factors Related to Closed-End Funds.

The risks associated with owning ETFs are usually lower but if an investor can take on the risk then the dividend yields of stocks can be. They are built on the idea of diversification pool investment dollars from a large group of individual investors and are generally managed by a team of Wall Street pros. Not every risk factor in this list will pertain to each closed-end fund.

Way of thinking with primary focus on the. Closed-end fund historical distribution sources have included net investment income realized gains and return of capital. The single biggest risk in ETFs is market risk.

But the closed-end fund may be trading at 1050 which would be a 5 premium. With at least oneof the words. This site does not list all of the risks associated with each fund.

Fundamental Risk Affects Closed End Funds In Which Of The Following Ways And thats where the similarities end. The value of a. There is generally no minimum investment needed to invest in closed-end funds.

There is no assurance that discounted funds will appreciate to their NAV. If stocks experience a bout of volatility then that can cause fund prices to fluctuate as well. Risks Securities in a portfolio of a closed-end fund may decline in value and the closed-end fund may not achieve its intended objective.

Where a fund may have provided tax indemnities after the event in relation to known tax issues and where there are issues over the validity of a tax position. No minimums Source. Now we will discuss risks associated with CEFs.

Closed-end funds are a lot like conventional Read More. Principal loss is possible. There is no guarantee a funds investment objective will be achieved.

In other words youre paying 105 for every. Closed-End funds can also be highly volatile during adverse market conditions due. Changes in interest rate levels can directly impact income generated by.

Credit Risk Credit risk is the risk that the issuer of a security will default or unable to meet its obligations to pay interest or principal as scheduled. 2 Management techniques into a management paradigm or. Over the long-term share prices of closed-end funds can track their NAVs.

Investment policies management fees and other matters of interest to prospective investors may be found in each closed-end fund annual and semi-annual report and also through press releases. Investing in closed-end funds involves risks. These funds try to minimize risk and invest in local and state government debt.

Closed-end funds may be leveraged and carry various risks depending upon the underlying assets owned by a fund. This is a significant risk for closed end bond funds as a default by one or more of the CEFs underlying bond holdings can have a significant impact on the CEFs NAV market price and ability to make distributions to shareholders.

Birla Sun Life Emerging Leaders Fund Series 3 Let Your Ambitions Soar Higher With Us High Potential Discovered Early A Closed E Investing Mutuals Funds Fund

New Fund Offer Lic Nomura Mutual Fund Diversified Equity Fund Series 1 A Close Ended Equity Scheme For 1100 Days Mutuals Funds Investing Best Investments

/GettyImages-1162966566-19102c67f9424a5d9b7eb826332ed48d.jpg)

Understanding Closed End Vs Open End Funds What S The Difference

Open Ended Vs Closed Ended Funds Fund Management Open Ended How To Raise Money

Morningstar Investment Research Center Provides Real Time Access To Comprehensive Data And Independent Analysis On Investing Online Resources Research Centre

Capital Protection Oriented And Dual Advantage Mutual Funds Mutuals Funds Investing Fund

/bonds-lrg-2-5bfc2b24c9e77c00519a93b5.jpg)

Open Your Eyes To Closed End Funds

Understanding Closed End Vs Open End Funds What S The Difference

The Ultimate Closed End Fund Investing Guide 14 Criteria For Better Yield Investing Dividend Investing Investing Money

What Are Closed End Funds Fidelity

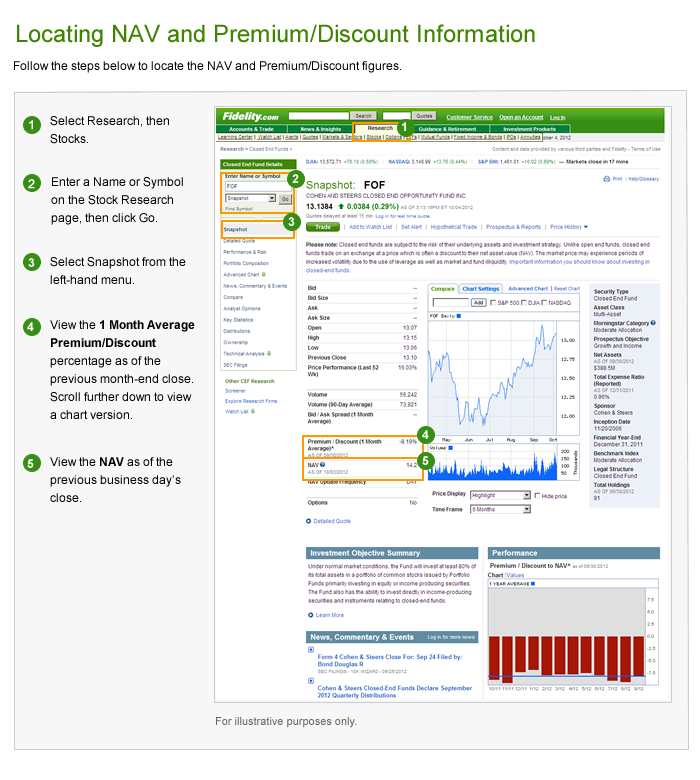

Closed End Fund Cef Discounts And Premiums Fidelity

What Is The Difference Between Closed And Open Ended Funds Quora

What Is The Difference Between Closed And Open Ended Funds Quora

4 Dividend Stocks In The Industrials Sector That Are Screaming Buys Entrepreneur In 2022 Dividend Stocks Dividend Math

Open Ended Vs Closed Ended Funds Stock Market Fund Management How To Raise Money

What Is A Closed End Fund And Should You Invest In One Nerdwallet

/155571944-5bfc2b9646e0fb005144dd3f.jpg)